Insurance Strategies For Business Owners

Protecting The Business

As a freelance developer, you are the business. You need to protect your business in addition to individual needs.

Industry Volatility

In tech, changing technology is a constant and you need to constantly upgrade skills.

High Stress and Burnout

The fast-paced nature of software development, tight deadlines, and high expectations can lead to stress and burnout.

Work-Life Balance

Long hours and demanding work can make it hard for a software developer maintain a healthy work-life balance.

Family Security and Future Planning

Provide family financial security for the future and when you are gone.

Build a Robust Financial Safety Net. The Basics.

Make a plan. a map.

Embark on your financial journey with a clear destination in mind. Are you aiming to:

- Passing the business to family?

- Travel the world?

- Ensure your family’s security?

- Put the kids through school?

- Retirement? What happens to the business?

- Start saving?

It can be simple or complex. It does not matter if you having nothing or are loaded. And it will change as circumstances change.

Without a solid plan, it’s hard to know if your actions are propelling you forward or holding you back.

Imagine diligently saving for years, only to realize you haven’t optimized your income.

Select the right tools for the job

Based on your goals, the plan will now address the critical question: How am I going to achieve my goal?

Achieving your financial aspirations involves a two-pronged approach: growing your current business and protecting against unexpected events that could deplete your assets at the worst possible time.

First, let’s talk about the growth of your assets. This could involve strategic investments tailored to your risk tolerance and financial objectives.

Equally important is protecting your assets from unexpected events. Life is full of uncertainties—health issues, accidents, or economic downturns can occur when least expected.

By combining asset growth with strategic protection measures, you create a resilient financial plan that achieves your goals and shields you from potential setbacks. This holistic approach is your roadmap to financial success, ensuring you stay on track regardless of life’s challenges.

review plan on a regular basis

Life changes. Priorities shift. For instance, starting a family might mean a shift towards more stable and long-term investments, while launching a business could require more liquid assets for potential opportunities or emergencies.

Empower yourself by regularly reviewing and adjusting your investment strategy. This ensures your portfolio remains dynamic and aligned with your goals, putting you in control of your financial future.

Protecting assets is no different. As you get older, there may be more assets requiring protection. At one time, you had a young family at home, and now they have grown and are on their own. Your coverages will change, but with an adaptable strategy, you’ll be prepared for whatever life brings.

A resilient financial plan is not static and will evolve as you do. Ensuring you stay on track.

Insurance Strategies For Business Owners

So, knowing how to build your robust financial safety net is one thing but actually making it happen is another. But don’t worry, I am here to help.

I’m Timothy, and I’ve been working with Professionals like you.

Hello, I’m Tim, a Life Insurance Advisor what works closely with iA Financial Group, dedicated to helping software professionals, particularly the self-employed and freelance, build robust financial safety nets.

My mission is to provide you with the tools and guidance necessary to protect your business, income, invest wisely, and secure a prosperous retirement.

Financial planning, within the scope of a life insurance advisor, involves creating strategies to protect your income, secure your family’s future, and ensure financial stability through various insurance products.

The focus is on identifying potential risks—like illness, disability, or untimely death—that could disrupt your financial goals and providing solutions that offer protection and peace of mind.

It does not stop there. Partnering with iA Financial Group allows me to do more. Should you require Wealth Management, Estate Planning, Pension Managment or Tax Expertise, iA has teams dedicated to support us.

Together we will assess your current financial situation and future needs, recommending a plan that will align with your goals. The process is about making informed decisions today to secure your tomorrow.

Timothy Ziebart

Licensed Life Insurance Agent

In Partnership With

Canadian Owned – Founded 1892

$229.3 billion in assets

More than 5 Million Clients

More than 9,500 employees

As at March 31, 2024

Benefits You Can Expect

Lifetime Support

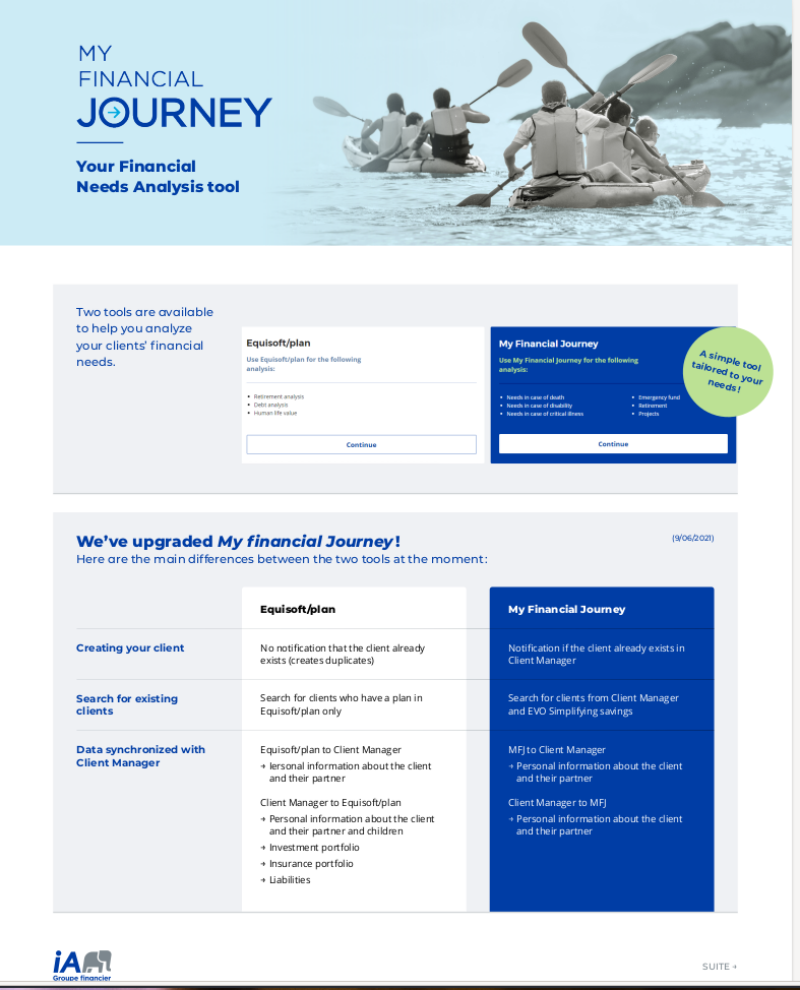

We use the “My Financial Journey” report to understand your situation. That is the beginning. Whether you are just starting your journey or you have a multi-million dollar estate, we will be with you for life.

Comprehensive Options

We offer flexible policy options to fit any budget while ensuring comprehensive protection. Including options with little or no medical underwriting.

Quick, Simple, Online Applications

Online application process. Product available that do not require medical underwring. Quick issue.

How IT Works

Step 1: Book A Virtual Meeting

Choose the most appropriate date and time. The entire process can be completed online, virtually.

Step 2: Attend the meeting

Sit in your favorite chair with you favorite beverage. Bring your questions. We take care of the details.

Step 3: Partner with Us

You are in control. Work with us to build a solution for YOU.

Here’s What May Be Available To You

My Financial Journey

Free No-Obligation Report. Build Your Plan.

Wealth And Tax Experts

iA Financial Group has an extensive team consisting of wealth management and tax experts available to assist you. Start small – Grow Big, we can help you.

Pick-A-Term Insurance

Need a 17 year term? It’s yours. Simplified term with little medical underwriting.

The Child Life & Health Duo

Child’s Whole Life with Critical Illness.

Life & Serenity 65

Whole Life with access to a monthly benefit that can be used to pay for long-term health care.

Participating Whole Life

iPar Estate for estate planning or iPar Wealth for long-term growth.

Genesis Universal Life

With an an indispensable financial planning tool.

CancerGuard

Simplified issue, cost sensitive critical illness with no medical underwriting.

Transitions Critical Illness

Up to 25 conditions covered with a flexible return of premium available after 5 years.

Universal Loan Insurance

Disability coverage for loans and that includes Rent!

Disability and Income Replacement

Accident only, simplified issue to full underwritten coverage. Starting at $84, annually.

Retirement Savings.

Full complement of RRSP’s, RIF, LIRA, Lif

Segregated Funds

75% and 100% Guarantees At Death and Maturity.

Guaranteed Funds

Guranteed funds including High Interest Savings Accounts.

My Education+

RESP program.

Annuities

Ready to get started?

Frequently Asked Questions:

I already have group insurance. I don't need insurance.

Congratulations, I am glad you have some protection. While group insurance is a great start some policies have limitations called Non-Evidence Maximums. NEMs. Look carefully at your policy and based on the information determine how much coverage you would receive on disability. Compare that with what you need.

Second, not all group coverage includes Critical Illness and the Life Insurance component is limited. Limited coverage can do as much harm as no coverage at all. If you would like to review your current situation I offer a free no-obligation consultation meeting. You have a right to know what is available and you have the right to say NO!

I don't make much and disability insurance is expensive.

The Insurance Company will limit the amount of benefit you qualify for based on your income. A good starting point is up to 60% of gross income or an amount less than this. The cost of DI will be determined by the benefit amount qualified for. Prices can vary dramatically based on other available options: accident-only policies, for example. The advantage of buying now, even at a small benefit, is once you have the policy most insurance company will not cancel the policy, even if you become uninsurable. Protect yourself today.

Do I really need insurance?

That is a good question. The answer is: it depends. Depends on what you are trying to accomplish financially. That is why the free no-obligation ‘My Financial Journey’ is a great way to start. We will take some time and review your situation and based on your answers determine if there is a need. Then it is up to you if want to do anything about it.