Given the dynamic landscape of personal finance, it is crucial to understand the distinction between a Life Insurance Advisor and a Financial Advisor.

A life insurance advisor focuses on protecting against risk, while a financial advisor offers solutions for wealth management.

📈💼 At times, they may appear similar but are quite different.

A Life Insurance Advisor like myself aims to protect what you have now and make you aware of and plan for potential risks in the future. I use different policies to manage particular risks, such as protecting income with disability insurance when you are unable to work, Business Overhead Expense protecting a business when the owner is unable to work, and Critical Illness to protect your assets from the unexpected costs of having one of the dreaded diseases. Life insurance can be great for generational wealth transfer, meeting anticipated expenses at death, or providing for a favorite charity.

While a financial advisor and a life insurance advisor can provide tools for growing wealth, I can guarantee the death benefit and investment value at policy maturity.

For example, compare a Mutual Fund offered by a financial advisor and a Segregated Fund by a life insurance advisor. Both funds can be invested in securities like Bonds or Equities. Typically, Mutual Funds available are more varied than Segregated Funds, with lower management fees, but Segregated Funds provide guarantees. Guarantees on the Death Benefit ensure that upon the investor’s death, the beneficiary may receive either the original investment amount or a higher amount, regardless of the market performance of the segregated funds. Guarantees at maturity ensure the investor will retain at least 75% or 100% of the original investment even if the investment collapses.

It is all about managing the risk of a potential market downturn. Do you have money to invest but cannot afford to lose it? Enjoy the benefits of a growing investment while protecting the downside.

A brief article like this cannot even describe the possible solutions for your unique situation. What you need is not the same as what your neighbor needs.

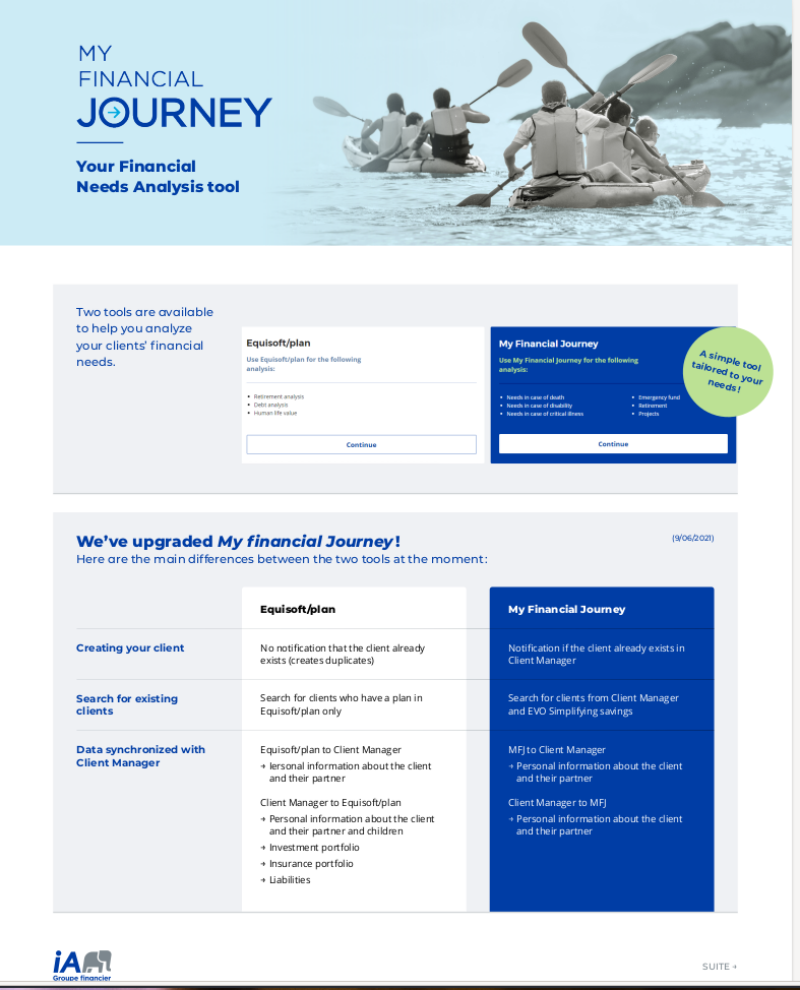

A life insurance advisor has tools like ‘My Financial Journey’ to provide the details necessary for you to make an informed decision; it will provide a map. A map that may change as your circumstances in life change.

Tell me what you are trying to achieve, and I will let you know if and what I can do to help you achieve your goals. If you want to discuss this further:, please book a meeting or call me at 604-882-5917; there is no fee or obligation. As a licensed life insurance advisor, I must advise citizens on the potential risks they face, but ultimately, you decide if you need to protect yourself.

In today’s dynamic personal finance landscape, both financial and life insurance advisors provide invaluable services. Knowing the difference will help you decide what you need and to whom to seek help.

What are your thoughts on this topic? Share below!

0 Comments