You have spent thousands of dollars and countless hours working toward your chosen profession. You have succeeded! Congratulations, you deserve it. Now you can enjoy the fruits of your labor and maybe a holiday. Looking ahead, you start planning for future events, such as raising a family, investing, and preparing for retirement. Your income is crucial to achieving these goals; you want to take full advantage of it.

Imagine that you have injured yourself and are unable to assist your clients. You have no income, and the bills still need to be paid – the mortgage, children’s school activities, food, utilities, clinic fees, etc. The stress begins to build as you are unsure of how you will pay the bills. And we all know how stress can hinder recovery from an illness or injury. There is a knock on your door and I am standing there to present you a cheque for $4000. Do you think that would be helpful?

I want to introduce you to an option that allows you to pay the bills while injured. Yes, I am referring to disability insurance or income replacement insurance. I can hear the refrain: “It’s too expensive.” It can be, depending on what coverage you choose. It does not have to be, as there are options for what is to be covered: income, household expenses, mortgage, or rent. You are unique. Your needs are unique.

In addition, an income replacement policy can help clients in occupations, like RMTs, that have a lower-than-average career expectancy to prolong or enjoy a whole career. During a disability, the need for an income often forces RMTs to reduce hours worked because they cannot afford to stop working. There are two consequences. First, they still suffer a loss of income, which could result in increased debts, lost savings, etc. Secondly, they do not have the time to recover fully and seek the medical care they need. You are suffering for years from a condition that will eventually become chronic and potentially end your career prematurely. You need the time to seek proper medical care and have the stress-free experience of not worrying about paying the bills. Get the care you need when you need it! That only helps to keep you in the profession you love longer and healthier.

But you say, “Tim, why not use my savings or pull some money from my investments because maybe I only have to claim once and never again?” That is true and a possibility, but so are multiple occurrences of injury. But let me ask you a question.

You have spent years saving, investing, and sacrificing with a goal in mind. You have dreams and desires for the future. Why allow a disability to put that in jeopardy? Use up savings that you may not be able to replenish. Cash in RRSPs prematurely and lose them for retirement. Dip into your investments, generating a shortfall at retirement. For a relatively small premium, you can protect what you have built. The dream is still intact.

You might also say: “What if I don’t make a claim? All those premium payments will be gone, right?” I have you covered. Return Of Premium options will return a portion or all the premiums paid if you never make a claim.

Yes, but you will tell me, “My spouse works.” Yes, but will one income cover the bills?

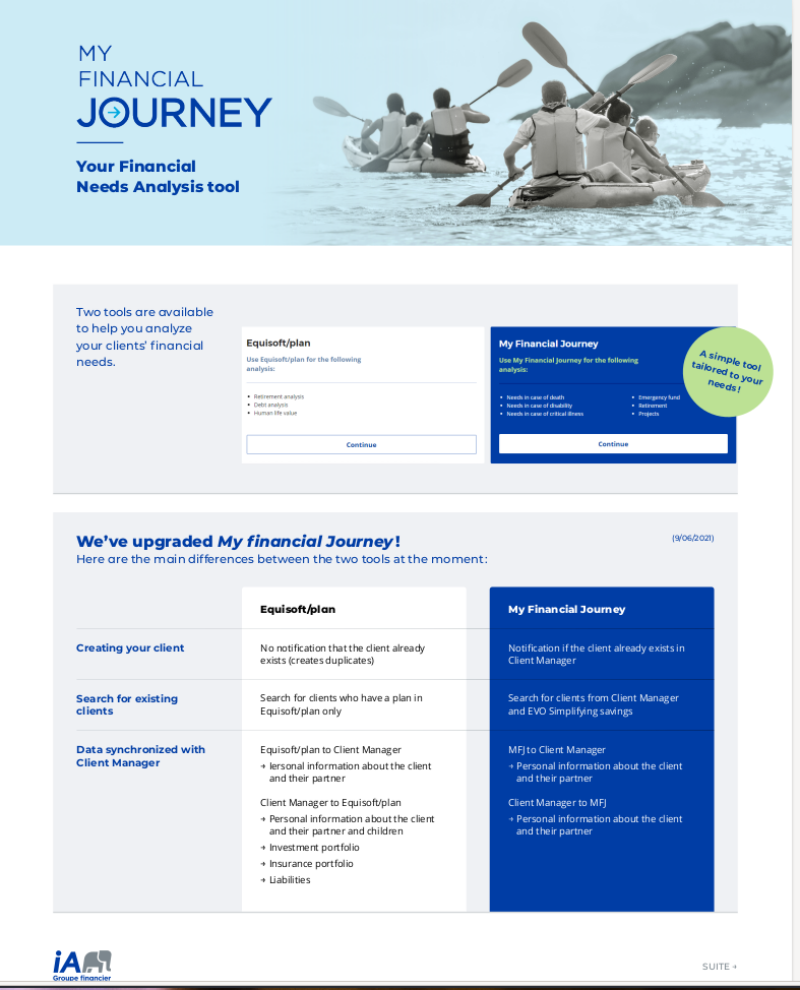

As an advisor, I have access to several solutions. I work with you to provide a solution that works and fits within your budget. You are not like everyone else. You are unique, and your needs are your own. It would be best to have a solution that adapts to you, NOT you adapting to it. Soft tissue injury is of particular concern, and unfortunately, many policies have restrictions on coverage for soft tissue. Through iA, we offer a solution with no soft tissue restrictions. Get the care when you need it.

Your income is your most important asset. Protect it. If you are interested, give me a call at 604.882.5917. Not sure? Call me. I offer a free review of your existing coverage, and we can do a review. I will even promise not to sell you anything.

You have a right to know what is available and a right to say no. Call me.

Tim

0 Comments